us exit tax green card

Yes even if you are not a covered expatriate under the Exit Tax tests and dont owe any Exit Tax you must file Form 8854. The visa status is the key determinant here.

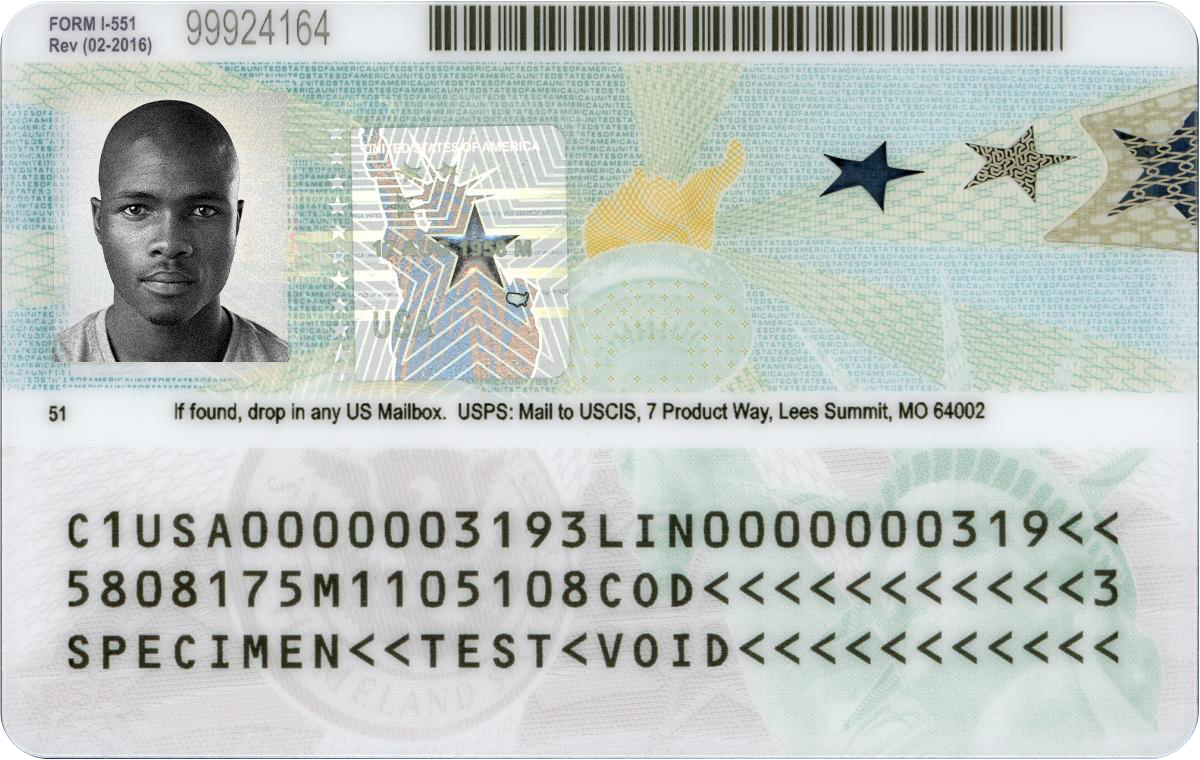

Form I 551 Explained Boundless

Citizen or a long-term resident.

. The Form 8854 is required for US citizens as part of the filings to end their US tax residency. Gifts to TrustsGeneral Transfer Tax Strategies As a permanent legal resident green-card holder the future covered expatriate domiciled in the US may take advantage of a full unified estate and gift tax credit 11580000 in 2020 by implementing general US. Exit tax applies to United States expatriates a term describing people who have renounced their US citizenship and those who have renounced a Green Card that they have held for at least eight years out of the.

There are two questions you need to ask yourself. Citizens Green Card Holders may become subject to Exit tax when relinquishing their US. Am I a US.

Who will be subject to the exit tax. And even if someone is a covered expatriate and subject to US exit tax it does not mean they will actually owe any exit tax although subsequent gift tax and 401k distribution issues may follow the covered expatriates in future years. For Green Card holders to be subject to the exit tax they must have been a lawful permanent.

Citizens who terminate their citizenship. Government or when the US. Lets talk about the exit tax implications of the treaty election by this green card holder to be treated as a nonresident of the United States for income tax purposes.

The exit tax process measures income tax not yet paid and delivers a final tax bill. Exit Tax is a tax paid on a percentage of the assets that someone who is renouncing their US citizenship holds at the time that they renounce them. Tax evasion and conspiracy to defraud.

Long-term residentslawful permanent residents of the United States holders of a green card visawho terminate that status after holding it for many years. In brief summary the HEART Act Exit Tax affects US citizens and permanent residents or Green Card holders who are planning to renounce their US citizenship or give back their Green Card. Income tax in one of three ways.

Transfer tax avoidance strategies before expatriation three years before expatriation. Depending on what the total gain is if the gain exceeds the exemption amount currently 725000 the expatriate may have to pay a US. The Exit Tax Planning rules in the United States are complex.

Ad Download or Email IRS 8854 More Fillable Forms Register and Subscribe Now. Citizens or long-term residents. Satisfying one of these will make the individual a resident alien fully taxable in the United States on worldwide income.

Its a little different for Green Card Holders if youre considered a long-term resident or Green Card holder for 8 of the past 15 years you could be subject to the exit tax. Green Card Exit Tax 8 Years Green Card Status Exit Tax at Expatriation What is a Long-Term Resident LTR. A noncitizen of the United States can become fully responsible to pay US.

Failure to file a tax return as a green card holder is punishable by fees of 5 of the total owed balance of taxes compounding up to 25 for continued failure to pay. This week I will cover one of them - the expatriation tax more commonly known as the exit tax. For reference not all green card holders can even be subject to US exit tax it only applies to covered expatriates.

When Does Legal Permanent Residency Expire. Underpayment of taxes can result in fees ranging from 20-40 of owed taxes depending on the circumstances and severity of the underpayment. If you are neither of the two you dont have to worry about the exit tax.

Your average annual net income tax for the 5 years ending before the date of expatriation or termination of residency is more than a specified amount that is adjusted for inflation 162000 for 2017 165000 for 2018 168000 for 2019 and 171000 for 2020. It is also required for long-term permanent residents who held their green card in at least 8 of the last 15 years. US Exit Tax IRS Requirements.

The expatriation tax rule only applies to US. But if you are a Green Card holder and have only had it for two years you may not be considered a long-term resident and then wouldnt have to worry about the exit tax. Government revokes their visa status.

The IRS requires covered expatriates to prepare an exit tax calculation and certify prior years foreign income and accounts compliance. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Immigration laws Residing permanently in the United States as an immigrant.

The exit tax applies to two categories of people. To trigger the exit tax the IRS must classify you as a covered expatriate. Exit Tax or apply for a bond which can be very expensive.

Green Card Status You have been given the privilege according to US. The most important aspect of determining a potential exit tax if the person is a covered expatriate. What if my Green Card Expired Several Years Ago.

In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or green card. By getting a green card visa and entering the United States. Green card holders are subjected to the exit tax rules when they abandon their green card status by filing Form I-407 with the US.

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Exit Tax Us After Renouncing Citizenship Americans Overseas

Matthew Ledvina Fintech Investment Fintech Venture Capital Tax Attorney

Camp Sites Sign W Directional Arrow Site Sign Camping Signs Campsite

I 551 Temporary Evidence Stamp Guide 2022

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Exit Tax In The Us Everything You Need To Know If You Re Moving

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Non Us Citizens How To Avoid Becoming A Tax Resident In The Us

Education Rates For U S Latinos On The Rise Infographic Education Lationo Education Educational Infographic Education Info

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

Do Green Card Holders Living In The Uk Have To File Us Taxes

Form I 551 Explained Boundless

Exit Real Estate Business Cards Thick Color Both Sides Free Ups Ground Shipping In 2022 Real Estate Business Cards One Design How To Apply

How To Apply For U S Citizenship And How To Renounce It

Green Card Holder Exit Tax 8 Year Abandonment Rule New